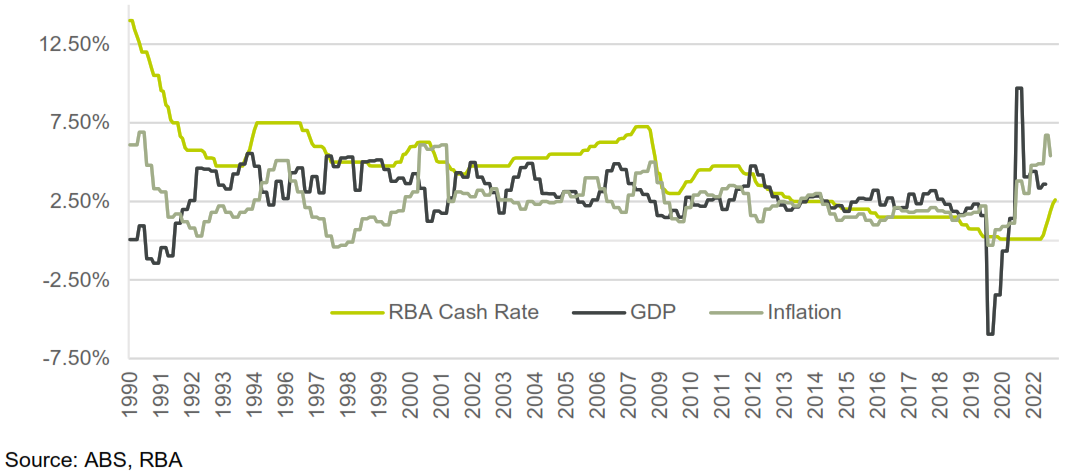

Yet another rate rise, with more to come. Last month’s slowing in the rate rises did not stop another rise this month. Inflation has remained unacceptable high, making the Reserve Bank of Australia more determined to do what is necessary to reduce it.

Cash Rates, Inflation, Wages Growth and Asset Pricing

- At the RBA Monetary Policy Decision meeting on 1 November 2022, they increased the cash rate target in line with expectations by another 25 basis points to 2.85%. They expect to continue increasing in the coming months as the bank remains “resolute in its determination to return inflation to target and will do what is necessary to achieve that”.

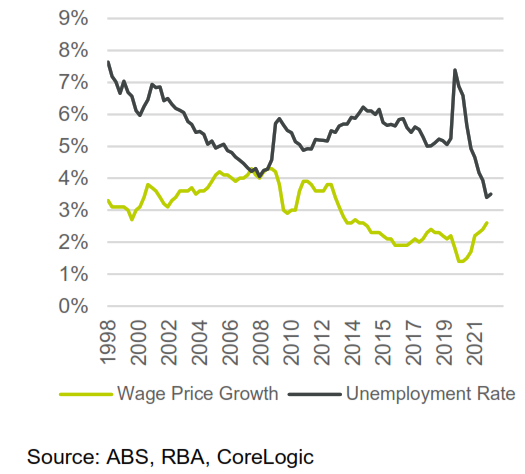

- Unlike last month, RBA is more pessimistic on its expectation of inflation. Forecasting a higher peak of around 8%. It is however hopeful that this will resolve itself with improving supply-side issues, declines in commodity prices and the broader impact of rising interest rates to reduce consumer spending. If this occurs, the RBA expects unemployment to rise from its 50-year low of 3.40% (in July 2022) to 4.0% in the near future. Some indication that this may be true was the slight uptick in unemployment to 3.50% in August 2022 and the increasing uncertainty in the outlook for the global economy, which has deteriorated over the recent months.

Exhibit 1: GDP, Inflation and RBA Cash Rate

Exhibit 2: Wage Growth and Unemployment

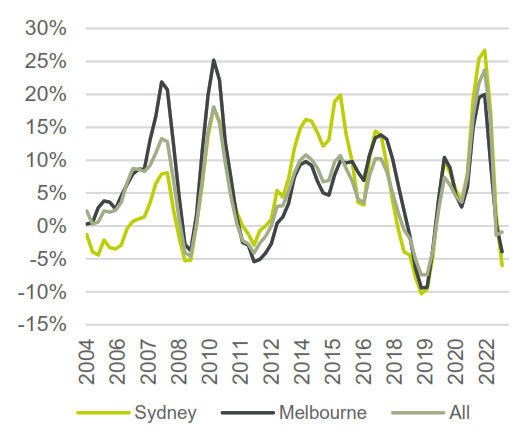

Exhibit 3: Annual House Price Movements

Funding Costs

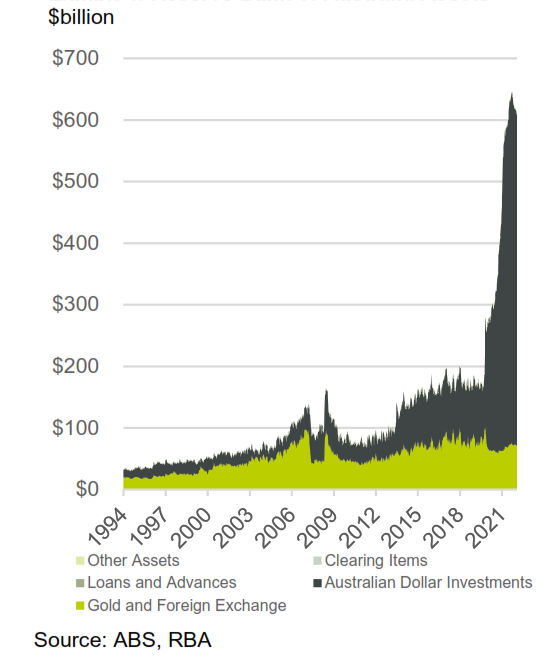

- The latest asset position of the RBA shows the the bank is starting to deleverage after its massive quantitative easing program initiated during the COVID pandemic. At this stage, the rate of change is only slight; however, it will have some impact on retail funding.

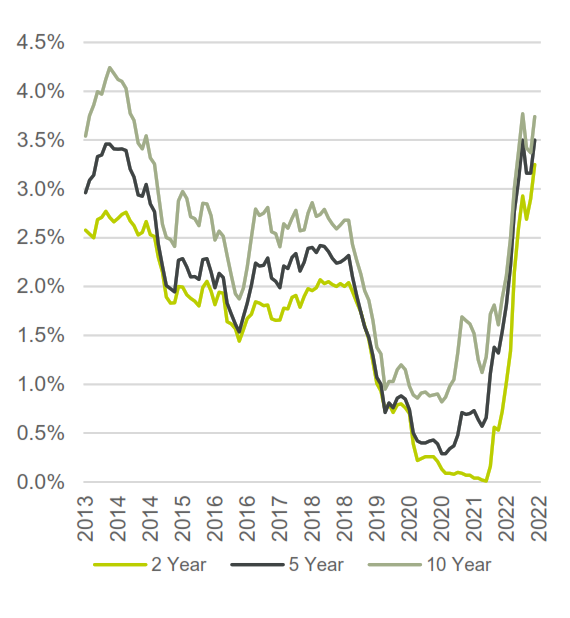

- The longer-term bond rates tend to forecast a potential stabilisation of the cash rate target at 3.50% to 3.75%, 0.90% to 1.15% higher than the current rates.

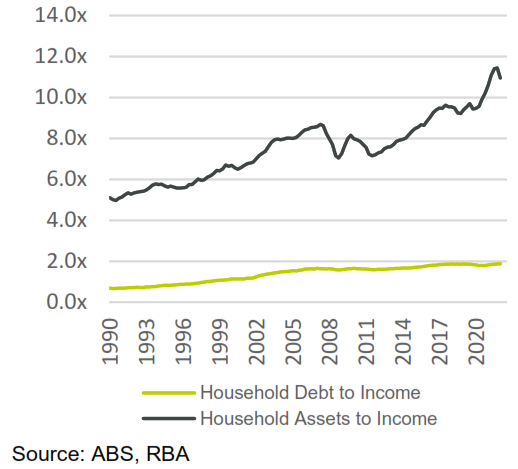

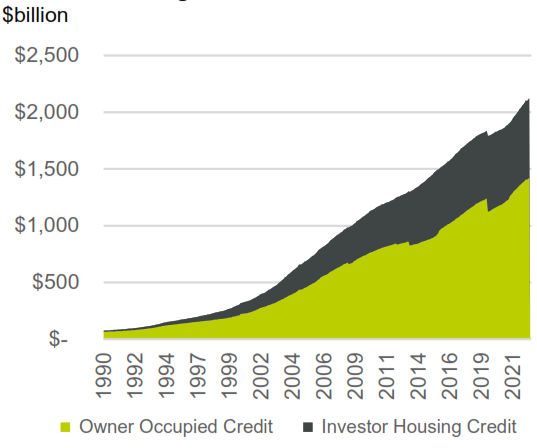

- The increase in interest rates and decline in housing prices can be seen in the reduction of total household-assets-to-income ratios and some slowing in the growth rate of consumer lending.

Exhibit 4: Reserve Bank of Australia Assets

Exhibit 5: Australian Government Bond Yield

Exhibit 6: Household Income and Consumption

Exhibit 7: Housing Loan Commitments

Implications on Interest Rate Outlook

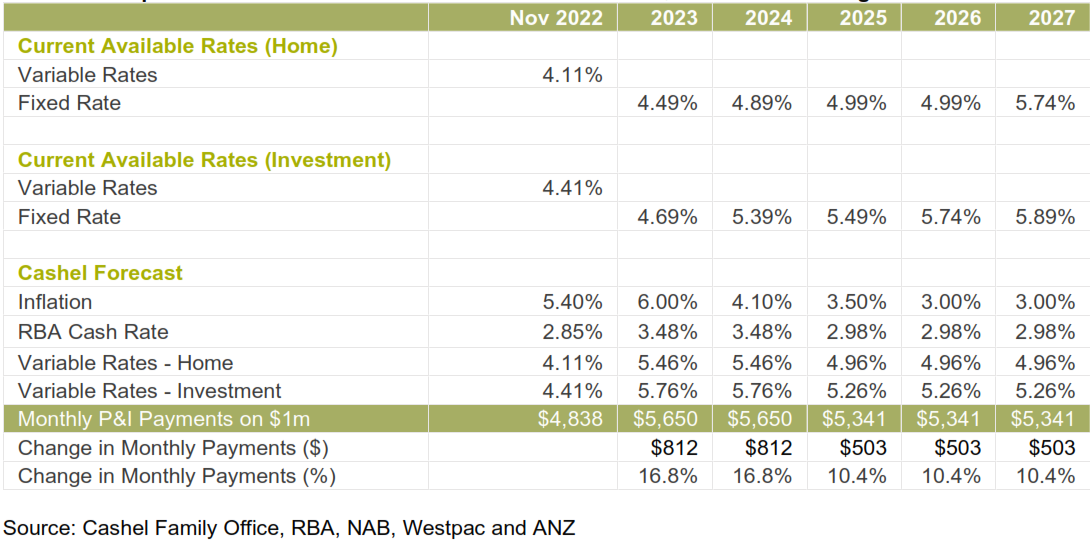

- From the current point we are forecasting a small increase in interest rates, having experienced the largest increases over the past 12 months.

Exhibit 16: Impact of Interest Rate Forecasts and Fixed Rates on $1 million borrowing

Recommended Stratgies

Given the current interest rate and economic outlook we are recommending to clients that they take the following actions:

- Be vigilant about their interest rates

- Review any way to make personal cost savings

- Review any way to diversify and grow their income, and

- Position for opportunities.

Most importantly reach out to your Cashel Relationship Manager or directly to me, should you need assistance and advice with any borrowing needs.