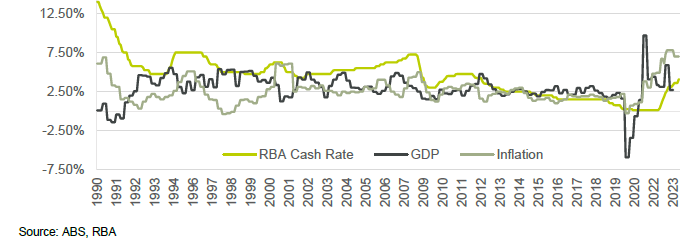

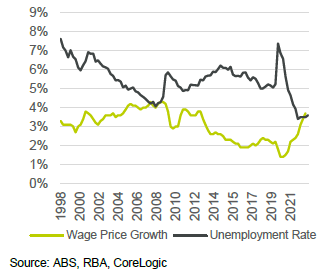

A bumpy path ahead? Is it possible to reduce inflation rates while maintaining positive gross domestic production, low unemployment and wage growth. While optimists would suggest this is possible, history and reality would suggest it isn’t. The current interest rate outlook is unpredictable.

Cash Rates, Inflation, Wages Growth and Asset Pricing

- Following the Australian Bureau of Statistics (ABS) release of the latest inflation rates of 7.0% in April (4% above the top of the target range) it was a foregone conclusion that the RBA would lift interest rates in June, and accordingly they did on the 6th of June, lifting the cash rate a further 0.25% to 4.10%. In doing so the RBA said Inflation in Australia has passed its peak, but at 7 per cent is still too high and it will be some time yet before it is back in the target range. This further increase in interest rates is to provide greater confidence that inflation will return to target within a reasonable timeframe.

- In Phillips Lowe’s speech on the 7th of June at the Morgan Stanley 5th Australia Summit, he made it clear that the RBA’s would not compromise on its mission to lower inflation to within its target range. In his speech, he made it particularly clear that should this come at the cost of lower GDP and higher unemployment, then this was a necessary cost to reset the inflation base. For borrowers (as this paper mentions) this is particularly important as higher interest rates and higher inflation both lead to a material reduction in borrowing power. The issue we see is that the RBA is fighting the battle with one hand tied behind its back, tied there through the national political scene which appears disinterested in helping with what would be the short-term unpopular task of reducing consumer spending and improving productivity (before mandating higher wages). Instead, it appears more intent to support the voting population with hand-outs.

Exhibit 1: GDP, Inflation and RBA Cash Rate

Exhibit 2: Wage Growth and Unemployment

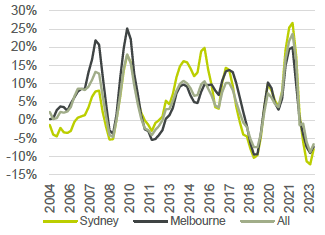

Exhibit 3: Annual House Price Movements

Funding Costs

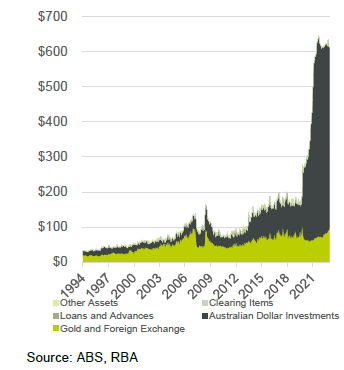

- There now appears to a noticeable reduction in the RBA asset position, however, not yet enough to reverse the COVID linked expansion. We expect to see more come off as the major and regional banks repay their COVID term funding facilities which are due for repayment on or before March 2024 (outside of the impact of market conditions to borrowers, this also should be considered a risk to the banks’ ability to maintain funding growth should this cause them to have liquidity issues).

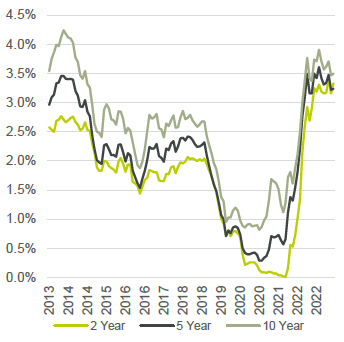

- Notwithstanding the latest rate rise, the longer-term government bond rates have remained around 3.2% to 3.5% for the coming 2-to-10-year period. Which is probably reasonable given the short-term rate rises that appear needed in the next 1-2 years (due to inflation).

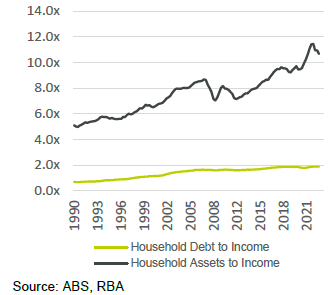

- Household assets to income ratio, as expected, declined slightly over the past quarter due to real estate asset price declines. Household debt to income remained stable, not due to income growth but due to reduced lending growth. As rates and unemployment goes up, these will change further.

Exhibit 4: Reserve Bank of Australia Assets

Exhibit 5: Australian Government Bond Yield

Exhibit 6: Household Income and Consumption

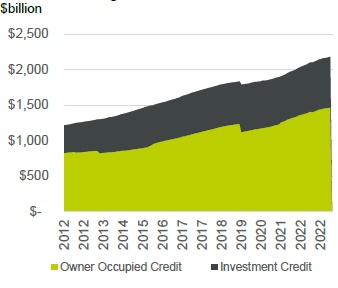

Exhibit 7: Housing Loan Commitments

Implications on Interest Rate Outlook

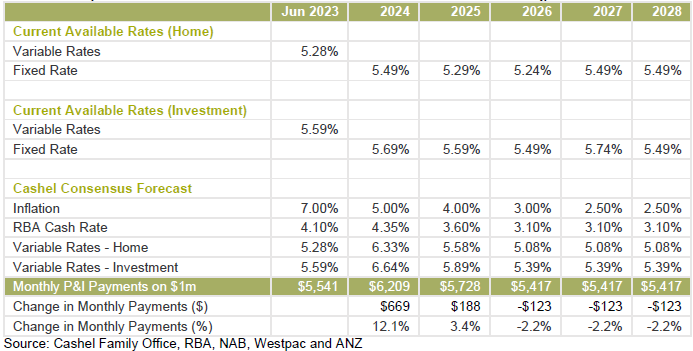

- Based on new consensus forecasts the expected peak cash rates may be as high as 4.85% (3 more rate rises) with a median of 4.35% (1 more rate rise). As mentioned in last month’s research, we tend to believe that the median consensus is underestimated and the likely outcome will be much higher, especially if the fiscal policy is neutral or unhelpful (as it appears to be). On this basis we expect to see home loan rates closer to 6.83% for recently refinanced borrowers and as high as 8.33% for older (carefree and loyal) borrowers. In the case of investment loan borrowers this may be 7.14% for new borrowers and 8.86% for older borrowers.

Exhibit 16: Impact of Interest Rate Forecasts and Fixed Rates on $1 million borrowing

Recommended Strategies

Given the expectation for between 1 and 3 further interest rate rises we are recommending to clients that they take the following actions:

- Act on the 2-3 year fixed rates options, especially on the basis that rates will likely go higher than expected, and stay that way for longer

- Position for distressed buying opportunities in Q1, 2024.

- Be vigilant about their interest rates reviews

- Review any way to make personal cost savings, and

- Review any way to diversify and grow their income.

Most importantly reach out to your Cashel Relationship Manager or directly to me, should you need assistance and advice with any borrowing needs.