Why so shocked? Over the past week, we saw a number of media headlines referring to RBA’s “shock rate rise”. The latest interest rate rise shouldn’t come as a shock given the high inflation is still well above target, and without government spending cuts the only way to tame it, is through further interest rate rises.

Cash Rates, Inflation, Wages Growth and Asset Pricing

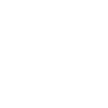

- On 2 May 2023, the RBA increased the cash rate another 25 basis points to 3.75 per cent. Inflation in Australia has passed its peak, but at 7 per cent is still too high, and it will be some time yet before it is back in the target range. Given the importance of returning inflation to target within a reasonable timeframe, the Board judged that a further increase in interest rates was warranted today.

- With inflation at 7 per cent, and the target range being 2 to 3 per cent, the RBA only had one choice, to lift rates. Cashel’s growing concern is that they have not raised rates enough and that inflation may become more embedded, leading to higher rate rises for longer. At the moment, the consensus median cash target rate forecast for 2023 is 4.1% (unchanged from our previous forecast), however after the latest inflation figures, there is a growing range of forecasts, with some expecting cash rates to increase as high as 4.35%, which would result in the variable home loan rates exceeding 6.33% for new borrowers and 7.83% for the average existing borrowers.

- In April 2023, the Australian Bureau of Statistics (ABS) provided a detailed breakdown of what is feeding inflation. The key drivers were medical and hospital services (+4.2%), tertiary education (+9.7%), gas and other household fuels (+14.3%) and domestic holiday travel and accommodation (+4.7%). Unsurprisingly most of these items are driven by government policy and are politically sensitive. It will be interesting to see if any of these are addressed by spending cuts in the budget release this week; without them, rates will continue to rise.

Exhibit 1: GDP, Inflation and RBA Cash Rate

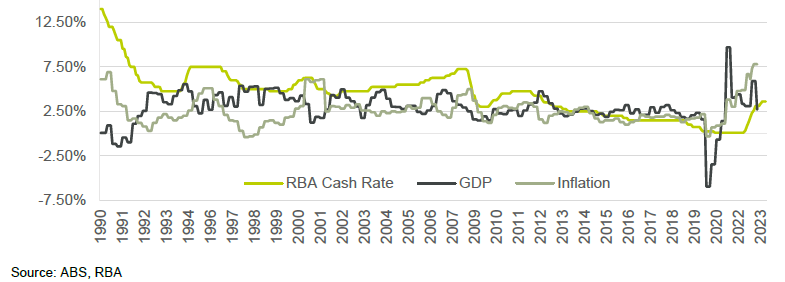

Exhibit 2: Wage Growth and Unemployment

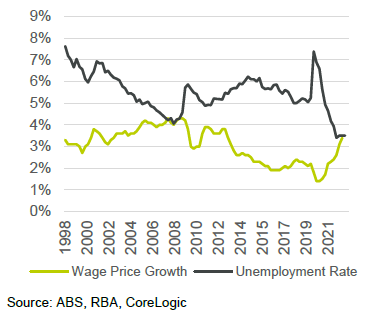

Exhibit 3: Annual House Price Movements

Funding Costs

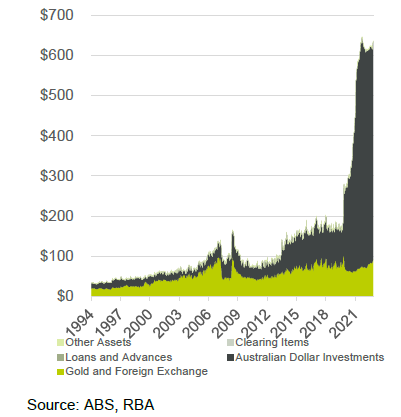

- Like previous months there has been little change in the RBA assets over the past quarter. We are starting to note a number of banks are reducing their appetite for construction and other types of lending, which may be a reflection of the challenging market conditions, or it could be in anticipation of their need to repay the RBA’s COVID term funding facilities.

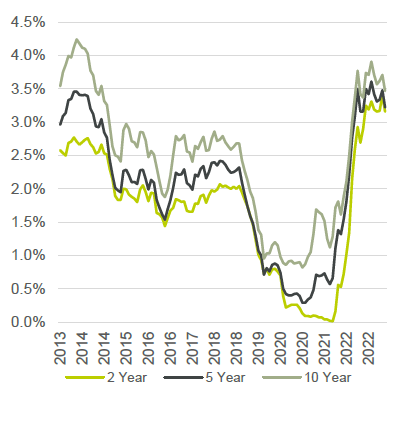

- The longer-term bond rates have remained around 3.2% to 3.5% for the past six months in expectation this is the required cash target rate to contain inflation (we have our doubts).

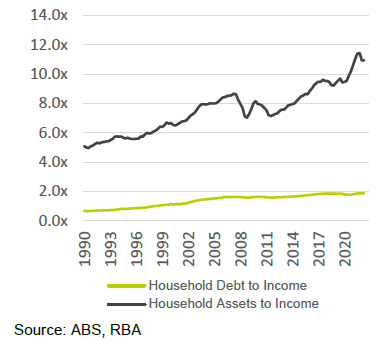

- Household assets to income ratio, as expected, declined over the past quarter due to real estate asset price declines. Household debt to income remains stable, not due to income growth but due to reduced lending growth. As rates and unemployment goes up, these will change further.

Exhibit 4: Reserve Bank of Australia Assets

Exhibit 5: Australian Government Bond Yield

Exhibit 6: Household Income and Consumption

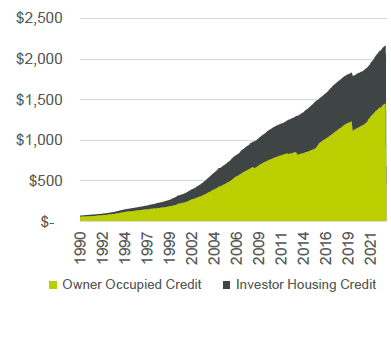

Exhibit 7: Housing Loan Commitments

Implications on Interest Rate Outlook

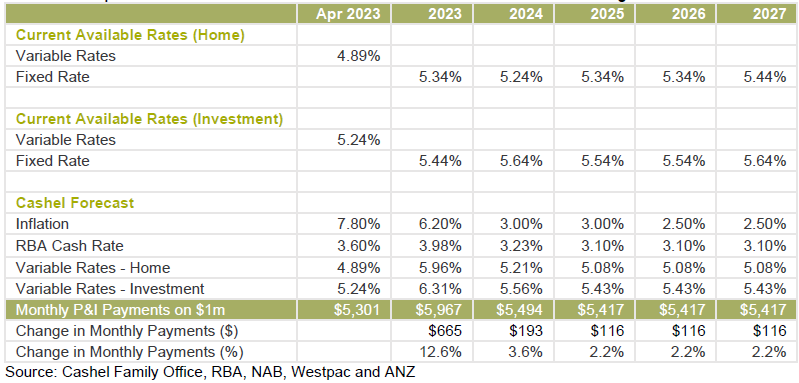

- Following the RBA rate rise last week and April’s inflation numbers, we are starting to see a growing divergence in the interest rate consensus forecasts. It appears rates are likely to rise higher and last longer, which can be seen in the Forecast (maximum conenses) below.

Exhibit 16: Impact of Interest Rate Forecasts and Fixed Rates on $1 million borrowing

Recommended Strategies

Given the current interest rate and worsening economic outlook we are recommending to clients that they take the following actions:

- Be vigilant about their interest rates reviews

- Consider fixed rates options, especially on the basis that rates will likely go higher than expected, and stay that way for longer

- Review any way to make personal cost savings

- Review any way to diversify and grow their income, and

- Position for distressed buying opportunities in Q1, 2024.

Most importantly reach out to your Cashel Relationship Manager or directly to me, should you need assistance and advice with any borrowing needs.